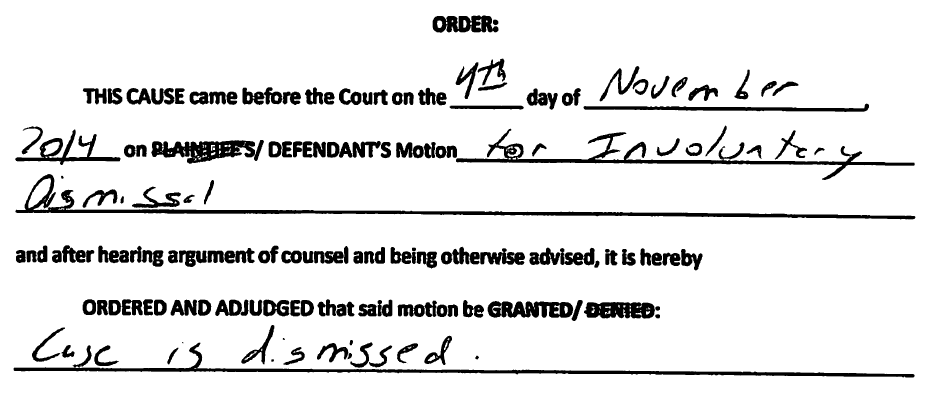

We had a great win just before trial started recently. This was a very special case, referred by a friend. The client had a lot going on in her life, including a foreclosure judgment and the pending sale of her home. She was successful in getting the sale reset three times but there was likely no judge in the world that would have reset it a fourth time. The first thing we had to do was get that judgment vacated! Based on a unique factual scenario, we found an angle and moved to vacate the judgment on the 363rd day after it was entered. We were really threading the needle on this but ultimately, we were on solid legal ground. The judge agreed with us and we were successful in unwinding the clock. The judgment was vacated and the sale was cancelled. We next amended our answer, fired off some discovery and then before long, the case got set for trial.

On the day before trial, the Plaintiff files a Motion for Continuance. They allege that the “servicing” was recently transferred. However, “Seterus has not received all the documents it needs from the prior servicer…” So, Plaintiff, now former servicer, is requesting a short continuance “to allow the current servicer additional time to complete the boarding process for the loan…” Plaintiff argues its position at the pre-trial docket sounding. I start my opposition to their Motion for Continuance stating that “this is a 2013 case. This is the second trial. Plaintiff noticed the Court that it was ready for trial and requested a trial date over a year ago. This second trial was set a few months ago. Even though the servicing transfer was effective a few months prior to the date of their motion, I’m sure this was in the works for some period of time prior to that. Yet, now, the day before trial, they move for continuance. What I find most disturbing is the basis, “boarding the loan.” “Judge, we’ve been in trial with the very witness Plaintiff will be calling in this case and in fact, every bank witness I’ve ever heard swears that boarding and verifying for accuracy is completed well before the servicing transfer is ever finalized. They often say something like, ‘the loan would not be transferred if everything is not checked and verified. Just the fact that I am here testifying indicates that the boarding was completed properly.’ Yet here we see, over two and a half months after the transfer of servicing has been completed, the Plaintiff is telling us that not only is boarding not complete, they still haven’t even gotten the documents! Something doesn’t sound right here…” The judge cuts me off, “I agree. Motion DENIED.”

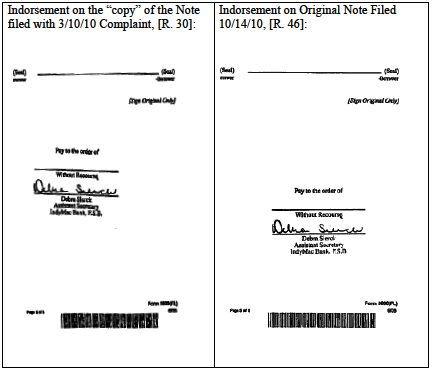

We get called to start trial about an hour later only now, the Plaintiff’s sole witness is upstairs in a trial with Judge Tuter. Our trial judge asks opposing counsel(OC), “how many trials was your witness set for today?” OC says, “I don’t know.” The judge then immediately says, “I’m granting a very short continuance. I want you back here next week.” I ask for the following day and the judge says that’s fine by her. OC fills out the trial date request form for the clerk. I fill in my bar number and ask the clerk to confer with me before finalizing the date. I sit down, dejected, trying to accept that I am about to wait for my continuance date even though I almost had a very easy win. (I have a written admission via Plaintiff’s Motion for Continuance that there was no boarding or verification of the prior servicer’s data. There are no prior servicer records. The acceleration letter is addressed to the wrong address and there are two “original” allonges, with no staples attaching them to the note, all in the court file, filed 6 months ago.) I watch the judge call up the next pair to start their trial but then, within about 10 seconds, I feel as if something just picks me up by the seat of my pants. I rush back over to the clerk and say, “don’t reschedule our trial just yet. I’m going up to Judge Tuter’s courtroom.”

The Rosen Law Blog

The Rosen Law Blog